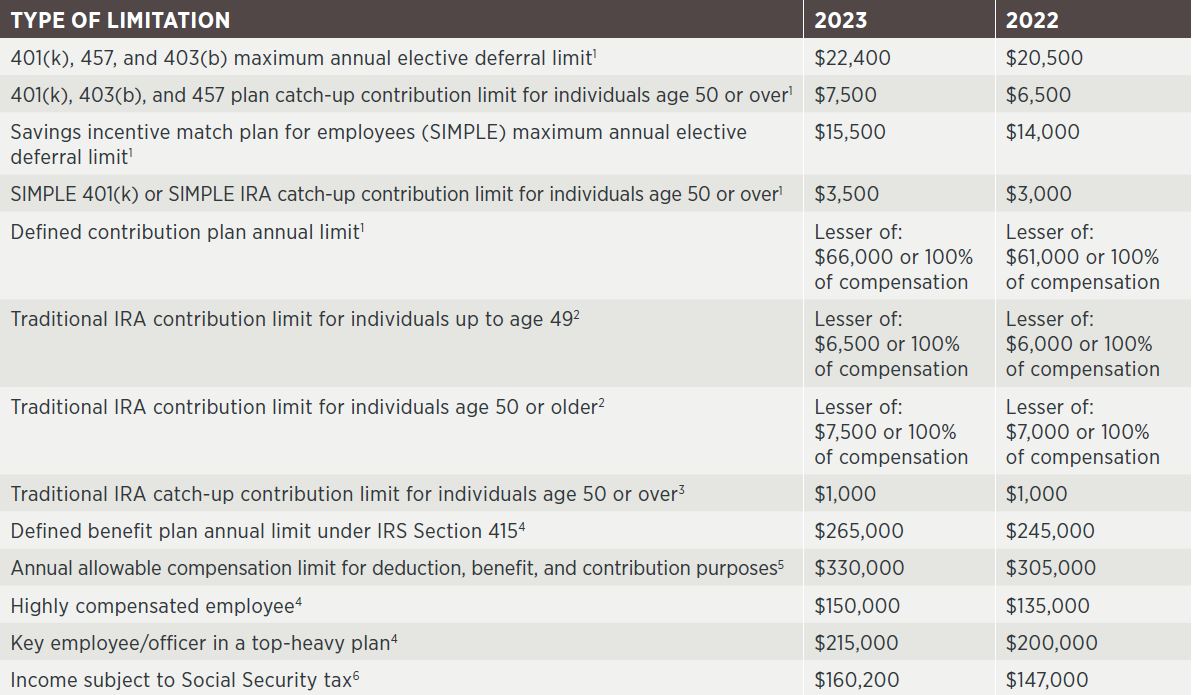

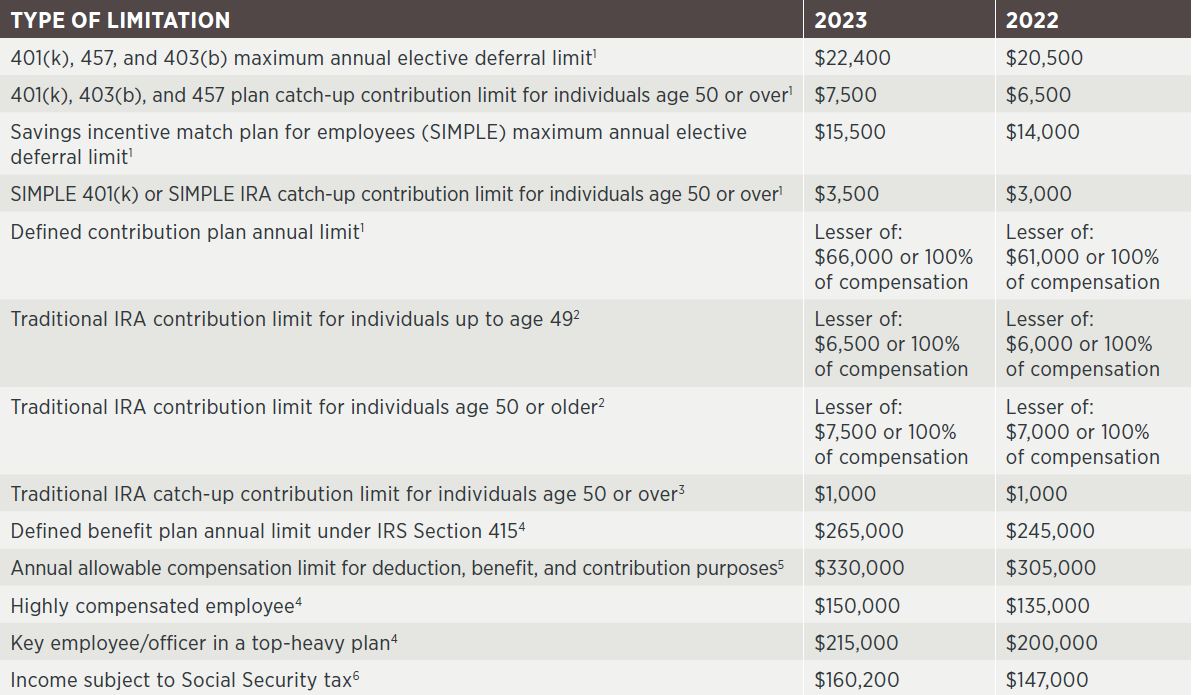

Annual contribution rates are based on the IRS 2023 retirement plan limitations and are subject to change. For full details on the pension plan limits for 2023, please visit the IRS website.

Annual contribution rates are based on the IRS 2023 retirement plan limitations and are subject to change. For full details on the pension plan limits for 2023, please visit the IRS website.

6 Meridian is a group comprised of investment professionals registered with Hightower Advisors, LLC, an SEC registered investment adviser. Some investment professionals may also be registered with Hightower Securities, LLC, member FINRA and SIPC. Advisory services are offered through Hightower Advisors, LLC. Securities are offered through Hightower Securities, LLC. This is not an offer to buy or sell securities. No investment process is free of risk, and there is no guarantee that the investment process or the investment opportunities referenced herein will be profitable. Past performance is neither indicative nor a guarantee of future results. The investment opportunities referenced herein may not be suitable for all investors. All data or other information referenced herein is from sources believed to be reliable. Any opinions, news, research, analyses, prices, or other data or information contained in this presentation is provided as general market commentary and does not constitute investment advice. 6 Meridian and Hightower Advisors, LLC or any of its affiliates make no representations or warranties express or implied as to the accuracy or completeness of the information or for statements or errors or omissions, or results obtained from the use of this information. 6 Meridian and Hightower Advisors, LLC assume no liability for any action made or taken in reliance on or relating in any way to this information. The information is provided as of the date referenced in the document. Such data and other information are subject to change without notice. This document was created for informational purposes only; the opinions expressed herein are solely those of the author(s) and do not represent those of Hightower Advisors, LLC, or any of its affiliates.

Hightower Advisors, LLC or any of its affiliates do not provide tax or legal advice. This material is not intended or written to provide and should not be relied upon or used as a substitute for tax or legal advice. Information contained herein does not consider an individual’s or entity’s specific circumstances or applicable governing law, which may vary from jurisdiction to jurisdiction and be subject to change. Clients are urged to consult their tax or legal advisor for related questions.

1 https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-401k-and-profit-sharing-plan-contribution-limits

2 https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-ira-contribution-limits

3 https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-catch-up-contributions

4 https://www.irs.gov/pub/irs-drop/n-22-55.pdf

5 https://www.irs.gov/retirement-plans/401k-plans-deferrals-and-matching-when-compensation-exceeds-the-annual-limit

6 https://www.irs.gov/pub/irs-dft/p15--dft.pdf

But not to worry. Simply know that by clicking Continue you will proceed to a third-party website.

Our link to this third-party website is provided for your convenience; it is neither monitored nor controlled by 6 Meridian.