A budget is a written plan that helps you keep track of how much you earn (your income) and how much you spend (your expenses). It’s perhaps the single most important tool for understanding how to manage your money, because it clarifies exactly where your money is going. You can also use your budget to figure out how much you can save and invest. Creating a system that makes sense can help ensure your money is doing what it should. It is important to take the time to set up the right tools and get organized.

STEP 1 | PLAN

Planning a budget involves identifying your income and figuring out spending priorities and trade-offs. Basically, you’re establishing a cash flow plan that lets you know how much you can spend each month—and how much you can save.

First, divide your expenses into two categories.

A simple but effective way to look at your expenses is to divide them into nondiscretionary (your needs) and discretionary (your wants) categories.

NONDISCRETIONARY EXPENSES are the “must haves,” such as your mortgage or rent, groceries, transportation, insurance premiums and taxes. Be sure to include debt payments such as credit cards and auto loans. You may find it helpful to include your savings and investing goals as line items in your nondiscretionary category (for example, retirement savings, education expenses or medical care costs).

DISCRETIONARY EXPENSES are the “nice to haves,” the extras such as restaurants, entertainment, travel and even clothing.

Don’t forget to set aside money for upcoming big-ticket items that come once or twice a year, such as insurance premiums and real estate taxes—they can be easy to forget when creating a monthly budget.

Then list your sources of income.

Where is your money coming from? Your regular wages are most likely your primary source of income. But don’t forget to add in other sources such as bonuses, gifts, income from rental property, interest or investment income, government checks or any other source.

STEP 2 | CREATE

Now put some real numbers into your plan. Add up your income, itemize your expenses and do the math.

Coming up short? Prioritize.

This is where you may have to prioritize in order to reach your goals. For instance, can you cut back on entertainment in order to save more? Would it be more economical to take public transportation than pay high gas prices?

STEP 3 | KEEP TRACK

Keeping your budget up to date and sticking to it are often the hardest parts—but they’re also keys to success. So once your budget is complete, monitor it regularly.

Budgeting tip.

If you’re having trouble staying on track, use spending trackers or budgeting tools to record spending every day for a week. It will help you see precisely where your money is going day-by-day—and give you ideas on where to make changes.

How to allocate expenses?

• Consider allocating no more than 50% of take-home pay to essential expenses.

• Try to save 15% of pretax income (including employer contributions) for retirement.

• Save for the unexpected by keeping 5% of take-home pay in short-term savings for unplanned expenses.

E S S E N T I A L

E X P E N S E S

50%

Some expenses simply aren’t optional—you need to eat and you need a place to live. Consider allocating no more than 50% of take-home pay to “must-have” expenses, such as: housing, food, health care, transportation, childcare, debt payments and other obligations. Just because some expenses are essential doesn’t mean they’re not flexible. Small changes can add up. Take a look at which essential expenses are most important, and which ones you may be able to cut back on.

R E T I R E M E N T

S A V I N G S

15%

It’s important to save for your future—no matter how young or old you are. Why? Pension plans are rare. Social Security probably won’t provide all the money a person needs to live the life they want in retirement. In fact, we estimate that about 45% of retirement income will need to come from savings. That’s why we suggest people consider saving 15% of pretax household income for retirement. That includes their contributions and any matching or profit sharing contributions from an employer. Starting early, saving consistently, and investing wisely is important, as is saving in tax-advantaged retirement savings accounts such as a 401(k), 403(b), or IRA.

S H O R T- T E R M

S A V I N G S

5%

Everyone can benefit from having an emergency fund. An emergency, like an illness or job loss, is bad enough, but not being prepared financially can only make things worse. A good rule of thumb is to have enough put aside in savings to cover 3 to 6 months of essential expenses. Think of emergency fund contributions as a regular bill every month, until there is enough built up. While emergency funds are meant for more significant events, like job loss, we also suggest saving a percentage of your pay to cover smaller unplanned expenses. Setting aside 5% of monthly take-home pay can help with these “one-off” expenses. It’s good practice to have some money set aside for the random expenses so you won’t be tempted to tap into your emergency fund or tempted to pay for one of these things by adding to an existing credit card balance. Over time, these balances can be hard to pay off. However, if you pay the entire credit card balance every month, and get points or cash back for purchases, using a credit card for one-off expenses may make sense.

These guidelines are intended to serve as a starting point. It is important to evaluate your situation and adjust these guidelines as necessary. The good news is that it isn’t about micromanaging every penny. Analyzing current spending and saving based on these categories can give you control—and confidence in your finances. Everyone’s financial situation will change over time. A new job, marriage, children, and other life events may change cash flow. It’s a good idea to revisit spending and saving regularly, particularly after any major life events.

Open the right accounts.

Banks and credit unions are where you can open up basic checking and savings accounts to manage day-to-day expenses and short-term savings.

Checking accounts are used to store money in the short term until it is needed, like for gas or groceries, or to pay bills. You can easily deposit or withdraw money through checks and/or debit cards.

Savings accounts are used to set money aside for use in the future, like for an emergency or a vacation, and allow the money to collect interest. While you can contribute money at any time to a savings account, unlike checking accounts there are limits on how often you can withdraw money.

Take the time to comparison shop different financial institutions and find services and features that are right for you. Electronic transfers, like directly depositing your paycheck and linking your savings and checking accounts, can help you better manage your finances and may make it easier for you to save.

What to look for:

• A checking account that pays interest

• No-or low-minimum balance requirements

• Unlimited free checking

• Free ATM withdrawals

• Good customer service

What to avoid:

• Monthly account servicing fees

• High fees for insufficient funds

• High account minimums

Apps and online tools are especially useful for visual learners. See where your money is going at a glance, and get real-time alerts when you’re at risk of going over your budget.

What do you want from your money, a down payment on a house, a new car, or a comfortable retirement? Take time to think about what’s most important to you and what you want your money to achieve.

Once you’ve determined your goals, write them down. Think of them as a road map, and then take one step at a time toward your destination.

Here’s a simple two-step approach:

01 | Divide your goals into three categories: short term (less than one year), medium term (one to five years), and long term (more than five years).

02 | Attach a dollar amount to each goal. For instance, a short-term goal might be a vacation. How much will it cost? The more specific you are about your goals, the more motivated you’ll be to work toward them.

Decide how much you can put toward each goal per month. Then use budgeting tools to help you estimate how long it will take to reach each goal. Be sure to track your progress regularly. It can be very gratifying to watch your savings build toward a goal.

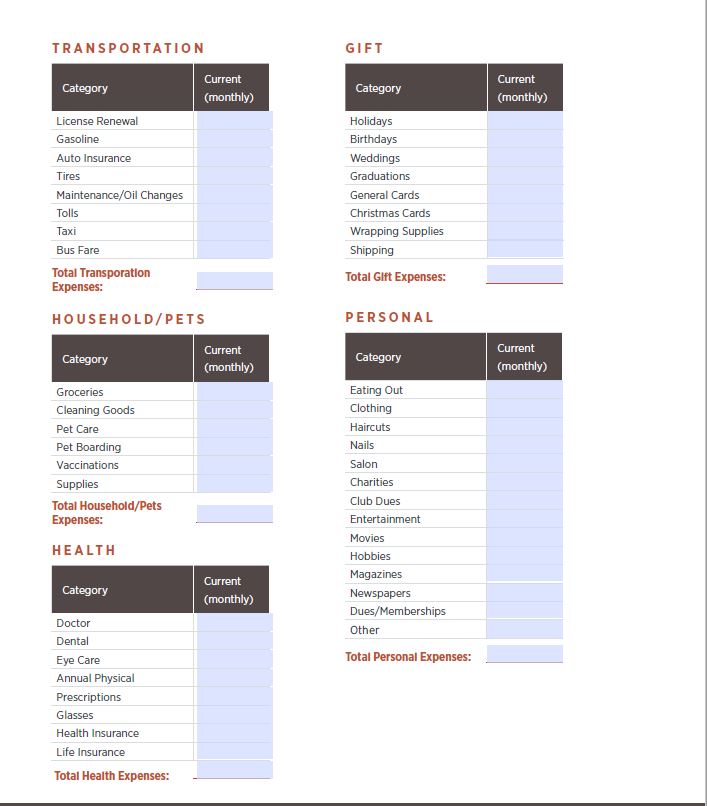

Budget Worksheet

This is a list of all the possible expenses you might encounter—all won’t apply, but this can give you a good chance to determine “must-haves” vs. things to cut!