If it feels like the stock market has had a volatile start in 2022, you are correct! Between geopolitical issues in Europe, seemingly never-ending inflation concerns, and an uptick in interest rates, there are plenty of things to be concerned about.

- Inflation: The US has reported its highest levels since the early 1980s due to a combination of: (a) record-breaking stimulus measures from Congress, (b) easy monetary policy from the Federal Reserve, (c) supply chain snarls dating back to the start of Covid, (d) imbalance in housing supply/demand, and (e) actual and perceived commodity disruptions due to the war in Ukraine.

- Geopolitical Risk: The economic impacts of the Ukraine war will be most damaging to economies with a greater trading reliance on Russia and Ukraine, but it will still impact the entire global economy as supply chain issues arise and drive up costs for everyone.

- COVID: A term that became the fastest addition to Merriam-Webster’s dictionary ever (34 days!) continues to cause issues. While most of the world has become more tolerant of the virus, China, a key player in our globalized economy, continues with their zero-tolerance approach. Given their status in the broader supply chain, shutdowns in China can reverberate across all economies.

- Central Banks: More specific to the US, the Federal Reserve has the difficult task of bringing down record high inflation without causing a recession. High inflation, low unemployment, more job openings than job seekers, etc. are all top of mind. The Fed raised its short-term rate for the first time in March 2022 and has signaled this is the start of an aggressive tightening phase.

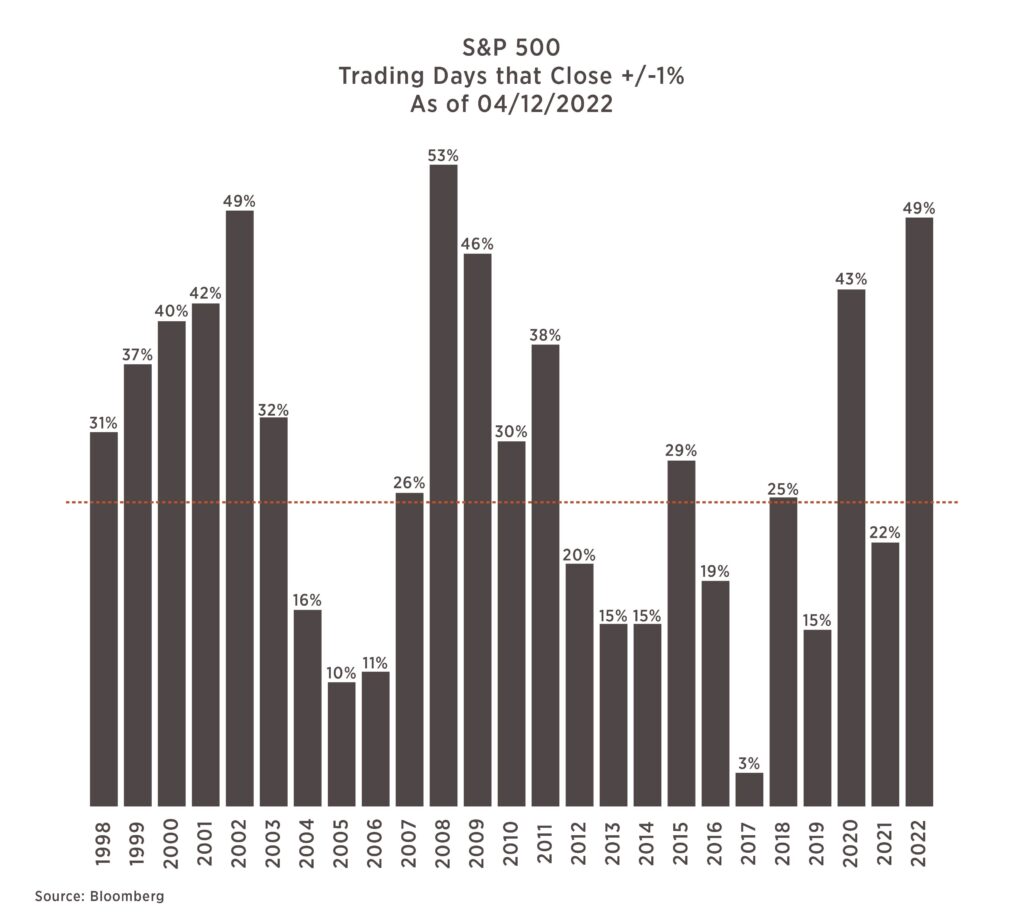

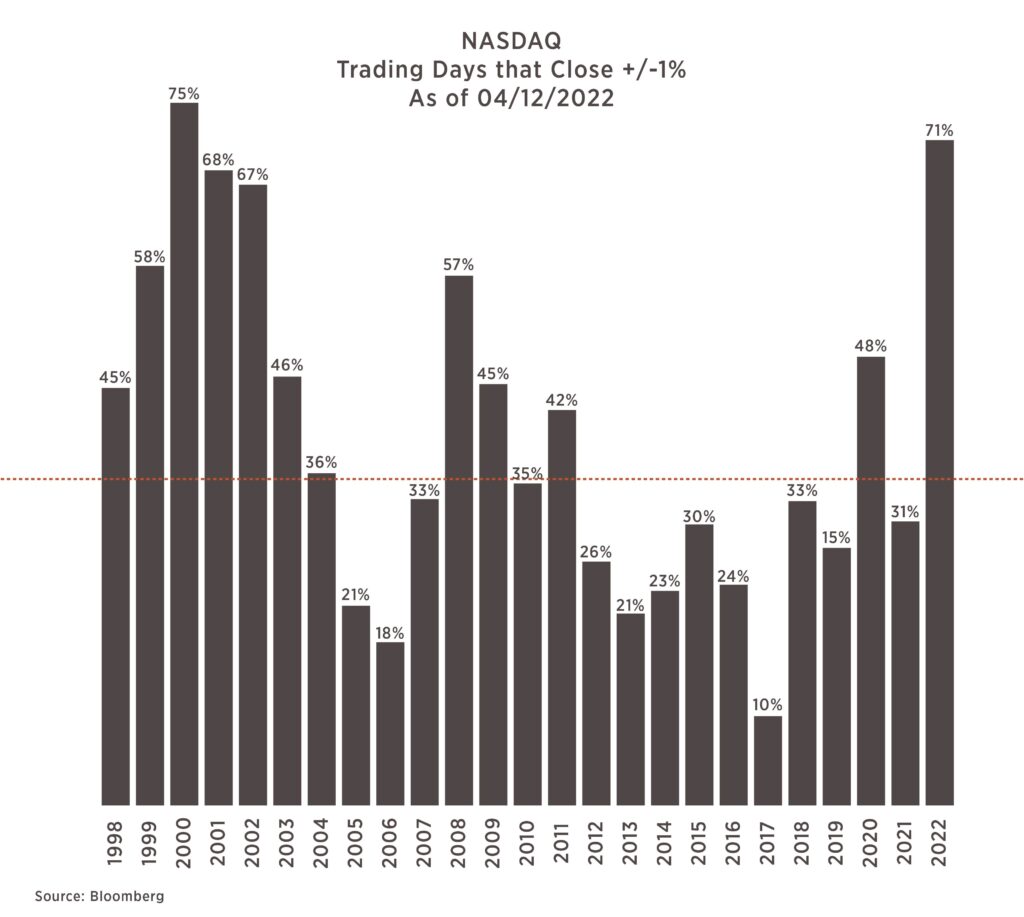

What follows are two charts that put the rough 2022 start into context.

Chart 1 (S&P 500) and Chart 2 (NASDAQ) show the frequency each index has closed +/- 1% from the previous day’s close.

This metric does not take into consideration the intraday movements, meaning if the S&P 500 was down ~2% at an intraday low but rallied to close only down 0.25%, it does not count. For the S&P 500, such instances of intraday moves occurred 15 times through April 14, 2022. Over the past 25 years, we have only seen this level of frequency twice for the S&P 500 – surrounding the tech bubble and the 2008 financial crisis. For the Nasdaq, such frequency has only occurred in one other period, the tech bubble of the late 1990s/early 2000s.

As the market continues to digest all the variables mentioned above, volatility could continue its current path. But as has been quoted from the ancient text “The Art of War” by Sun Tzu – “In the Midst of Chaos, There is Also Opportunity”.