There is no single indicator that can tell us how best to invest. However, we find it is vital to keep pace with economic and market data that show what current and potential future trends are taking shape. To do this, we look at signals from equity and fixed income markets as well as from the real economy.

Here are some of the indicators we use to map out where the economy and markets may be headed.

Economy

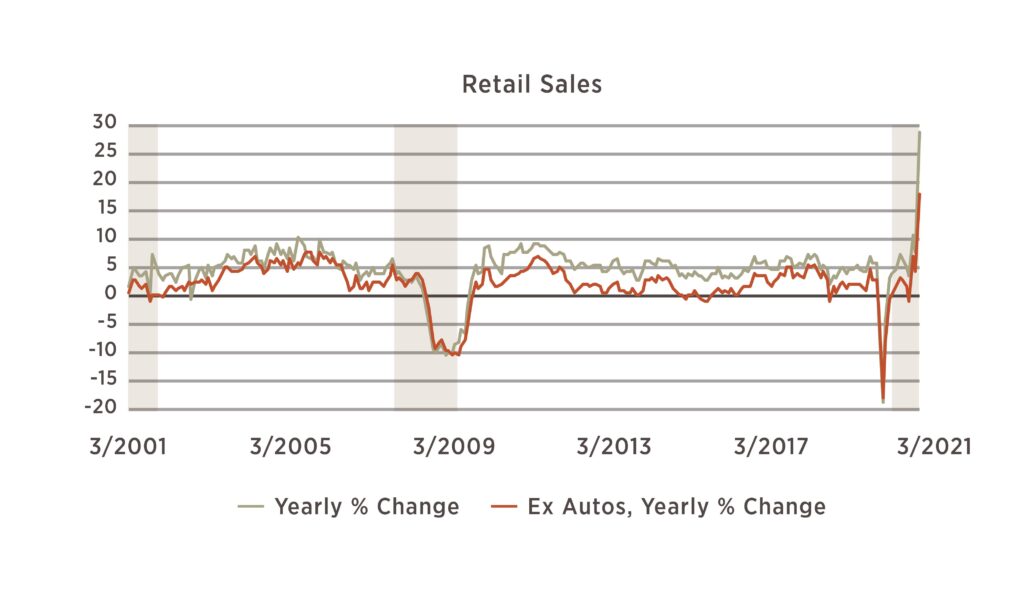

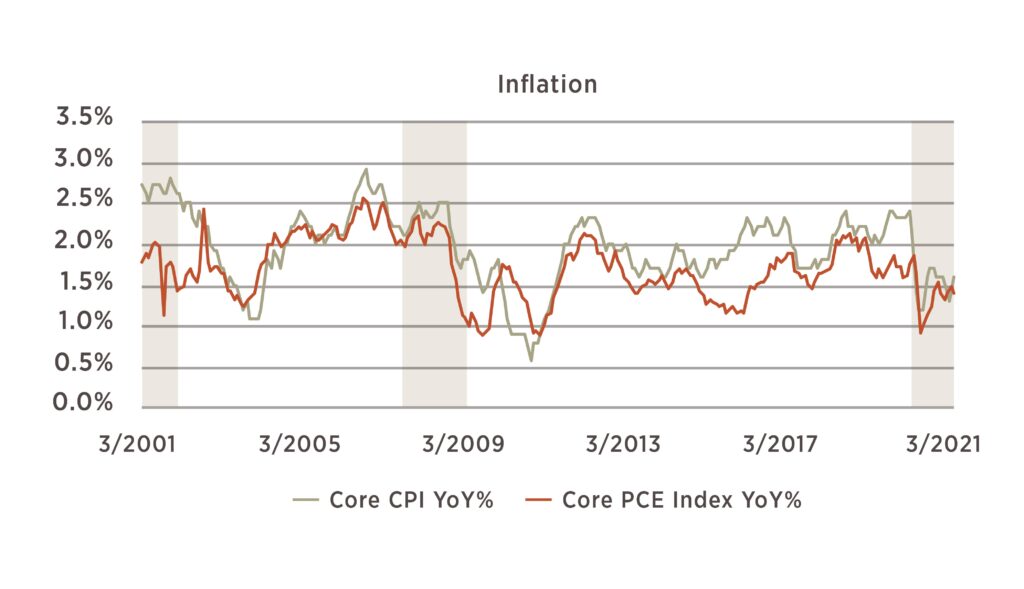

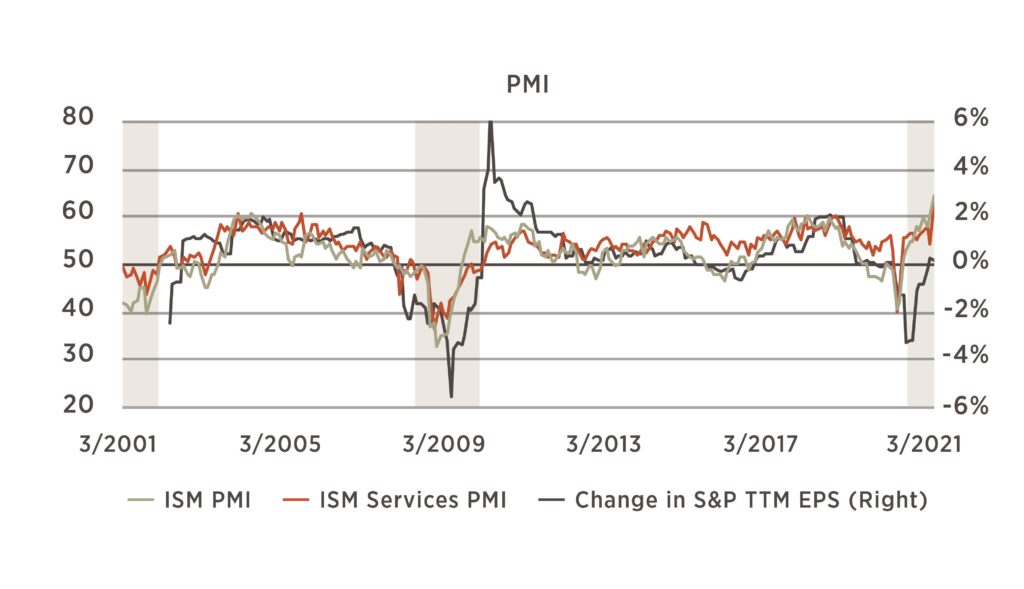

Economic data for the month of March hint at an accelerating pace of recovery as more industries are able to move forward with reopening. Unemployment continued to decline to 6%. Retail sales grew by a massive 27.7% from the restrained levels of last March, boosted by growth of nearly 10% in the most recent month. Despite this increase in demand, inflation held steady with the CPI showing a 1.6% year-over-year increase in core prices and a 2.6% increase once food and energy are included. Both the manufacturing and services PMI indicators continued to climb – to 64.7 and 63.7, respectively. The gain represents a continued pickup in business activity, as levels above 50 for these indicators reflect expansion. This could bode well for S&P 500 earnings as we move through the 1st quarter reporting season.

Forward Indicators

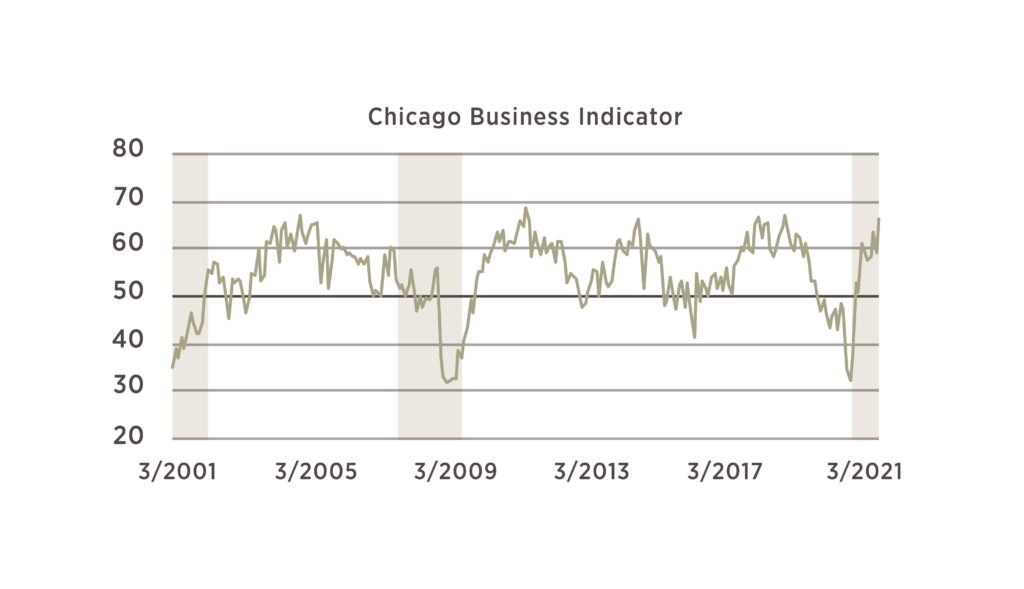

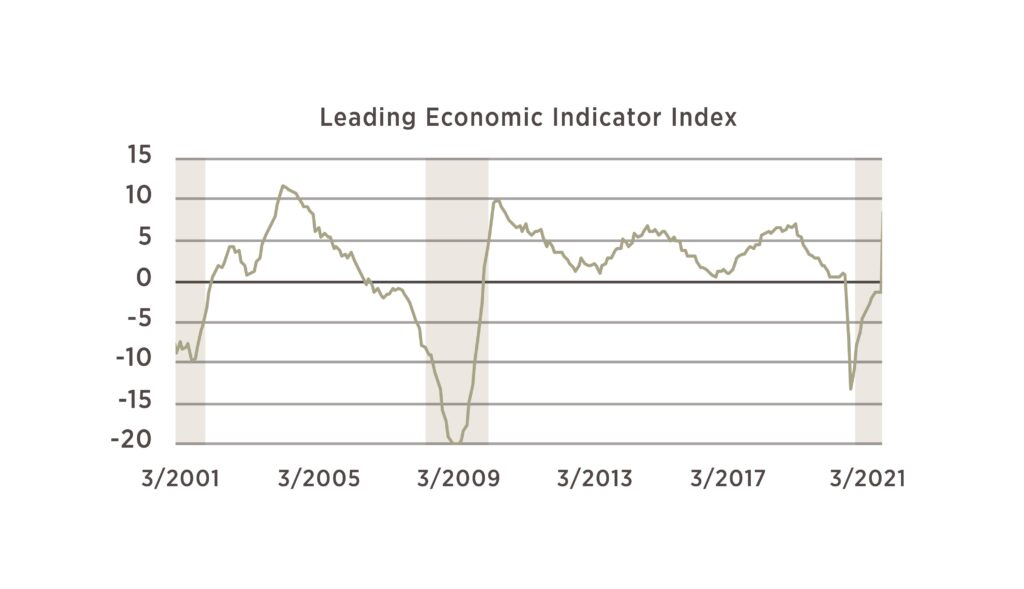

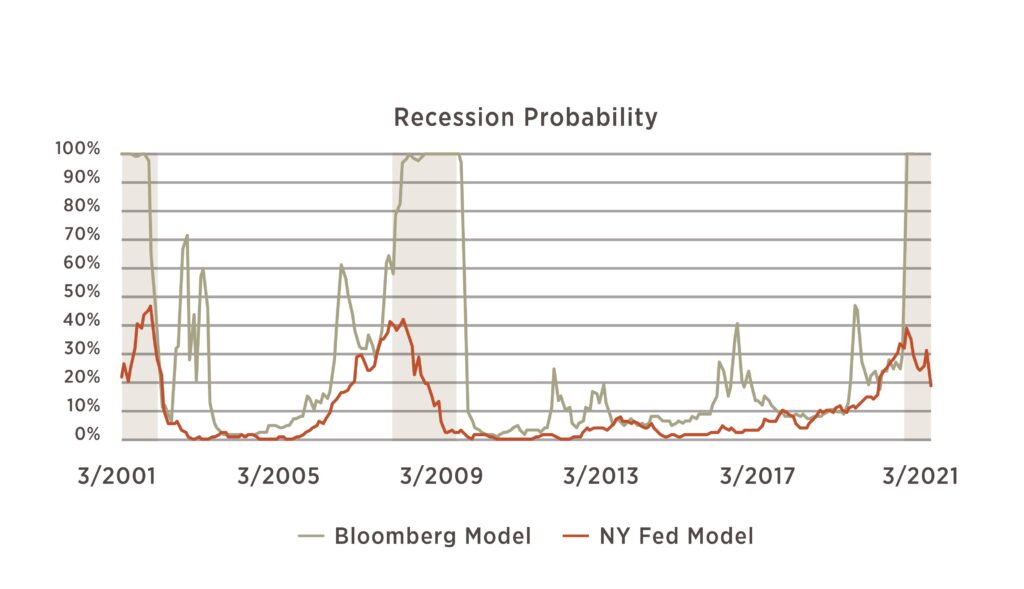

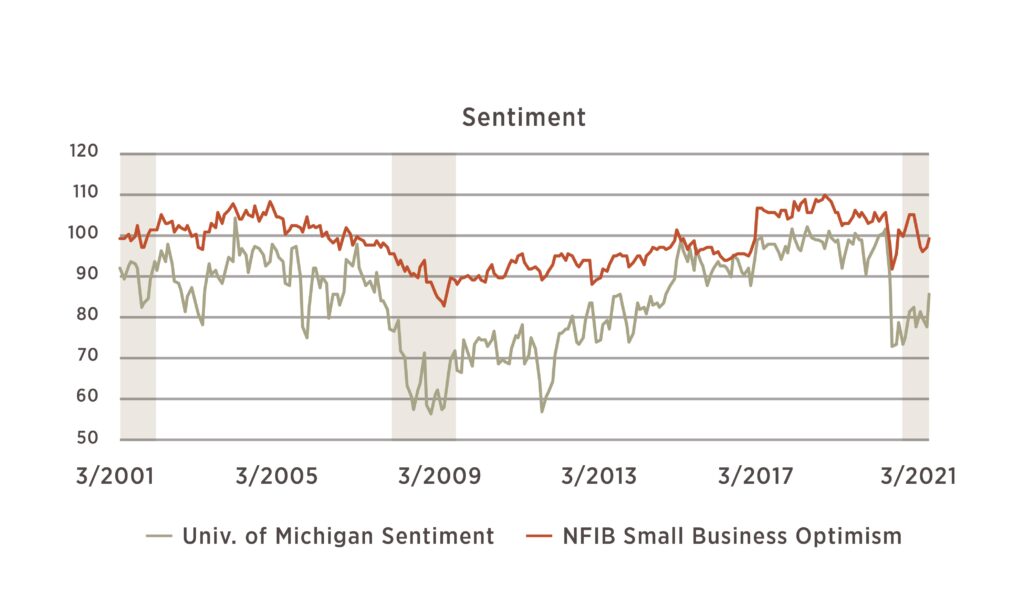

Leading indicators, which we use to gauge expectations of future economic activity, have also picked up. The Chicago Business Indicator, which gauges business activity and investment intentions, rose to 66.3 this month (readings above 50 indicate expansion). The index of leading indicators improved considerably over the month as well as on a year-over-year basis, posting a 7.9% improvement from the lows of last spring. Measures of both consumer and business sentiment also showed improvement in March.

Equity Market Valuations

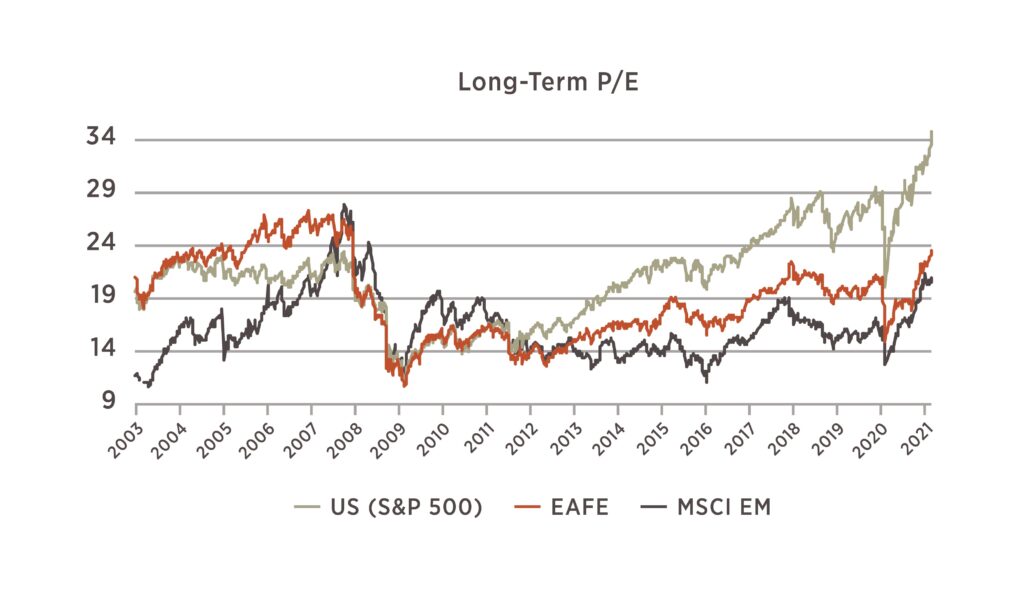

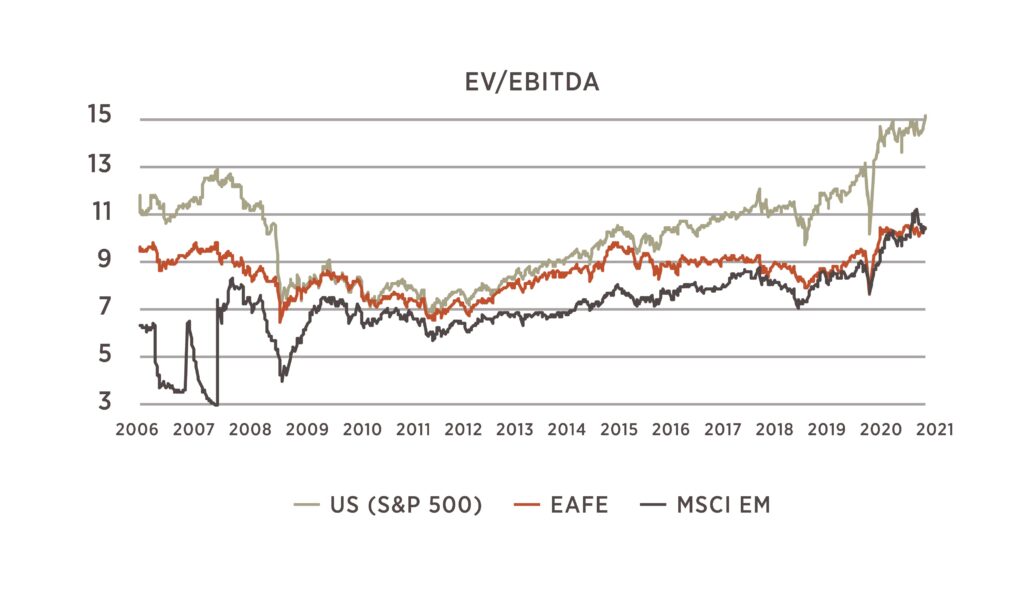

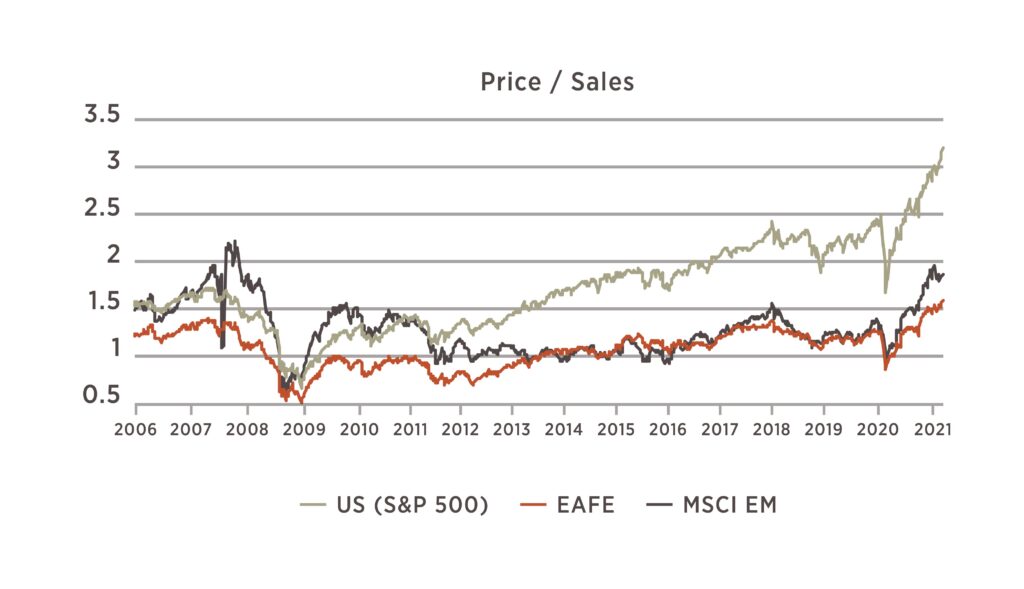

We include several measures of valuation for stock markets to get a more thorough picture than any one measure would provide. Currently these measures are all telling the same story – US stocks look very expensive relative to their history and relative to non-US markets, especially after the recent upward move in prices. While these ratios may not revert fully back to historically normal levels, it is unlikely that they will continue to expand indefinitely. The current high level of valuations means that it will be difficult for stocks to continue to move upward even as the economic and earnings situation continues to improve.

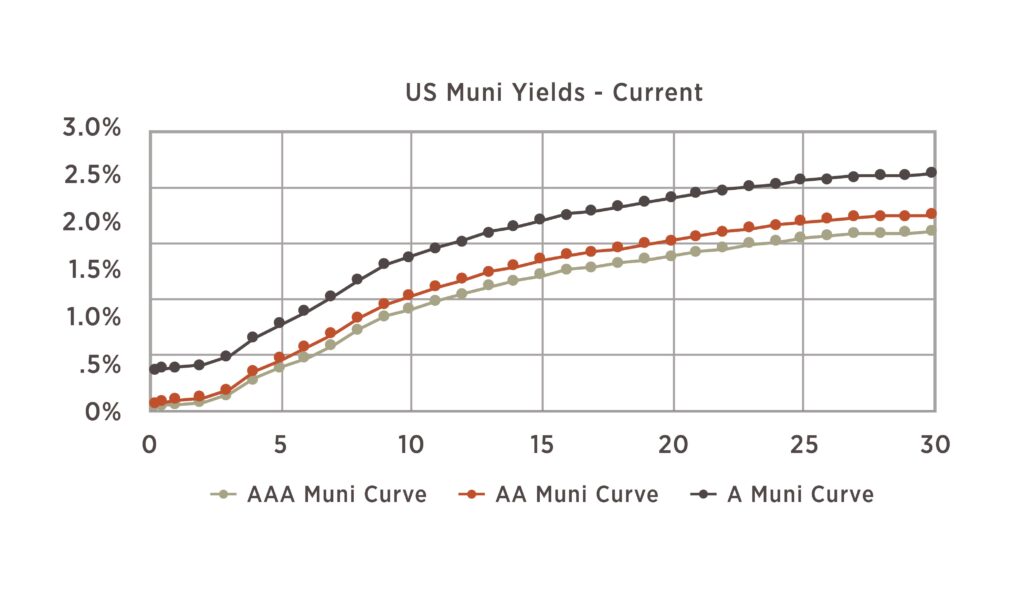

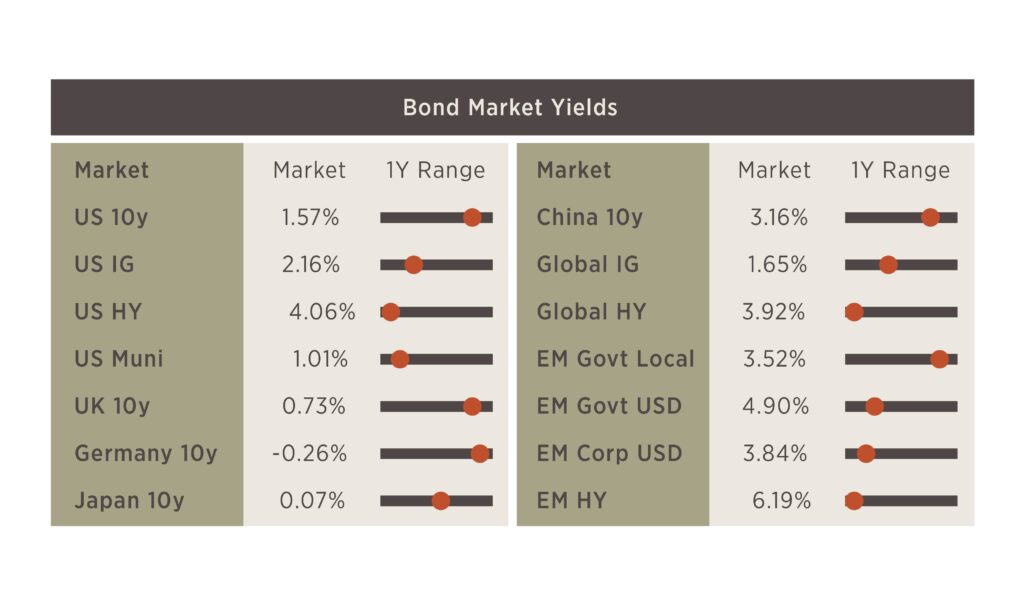

Fixed Income

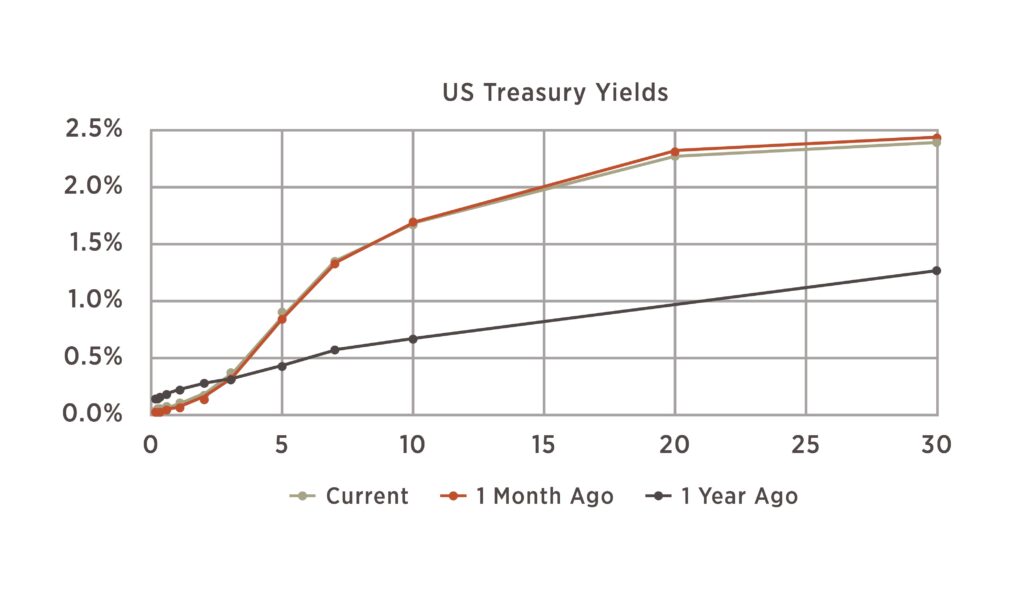

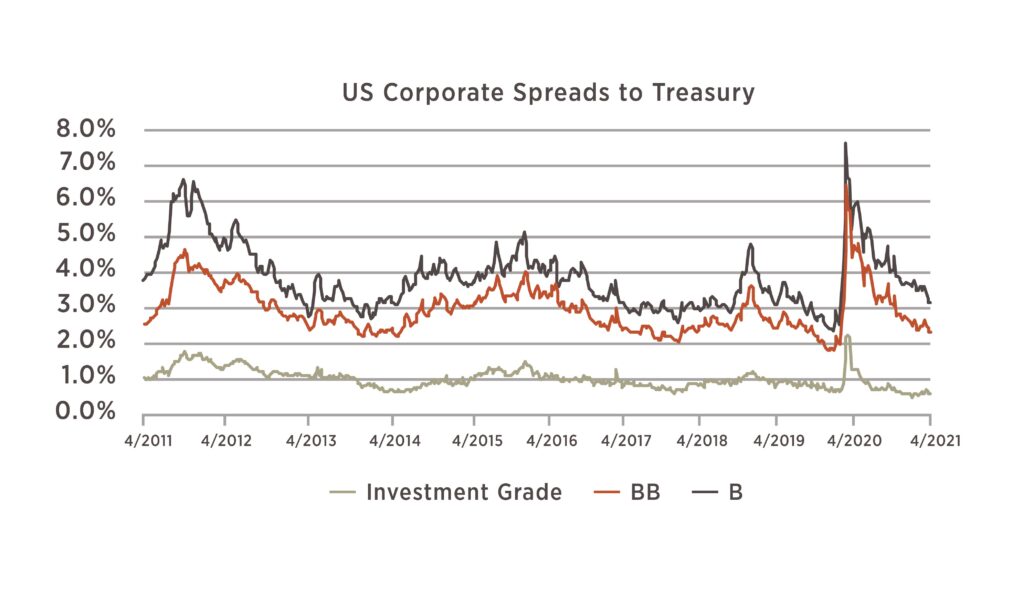

In fixed income markets, the US Treasury yield curve has steepened as longer dated yields rose throughout the first three months of the year. The 10-year yield now sits at 1.6%, which is near the levels we saw in late 2019 and early 2020. Corporate spreads, representing the additional yield offered to take on corporate credit risk, have continued to come down to historically low levels. Spreads on investment grade bonds are not only narrower than they were in 2019, they are around the lowest point in the past ten years. High yield spreads – including the BB and B rated bonds on this chart – remain wider but have also continued to compress. Investors seeking yield within fixed income are left with few good options without taking on substantial credit risk.

Source for all graphs: Bloomberg 2021, Analysis by 6 Meridian

The information and data contained in this report are from sources considered reliable, but their accuracy and completeness is not guaranteed. This material has been prepared solely for informational purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any security or other financial instrument, or to participate in any trading strategy.

Securities offered by Registered Representatives through Private Client Services, Member FINRA/SIPC. Advisory products and services offered by Investment Advisory Representatives through 6 Meridian LLC, a Registered Investment Advisor. Private Client Services and 6 Meridian LLC are unaffiliated entities.

Investors cannot invest directly in an index and unmanaged index returns do not reflect any fees, expenses or sales charges.

Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by 6 Meridian LLC unless a client service agreement is in place.